Blog

Mosaic Announces Strategic Integration with S&P Capital IQ Data

This integration empowers private equity firms and investment banks on Mosaic to conduct complex take-private analysis in under one minute, leveraging Capital IQ’s extensive dataset, including fundamental financials, consensus estimates, and real-time market pricing – paired with the user’s differentiated judgements on appropriate capital structure and exit for the deal.

Unveiling Mosaic Vision™: The World's First AI-Powered Financial Model Reader

Mosaic Vision™ is the world's first commercially available financial model reader and translator powered by Artificial Intelligence ("AI"). With Mosaic Vision™, investors can take a screenshot of a set of financials (e.g., from a CIM, pitch book, public company investor presentation, etc.) and by uploading it to Mosaic Vision™, be instantly able to (i) adjust growth rates, margins, and other forecast items; (ii) clone upside, base, and downside cases; and (iii) add transaction assumptions to calculate deal returns (e.g., IRR, MOIC, etc.) – all from a static page and without opening a spreadsheet.

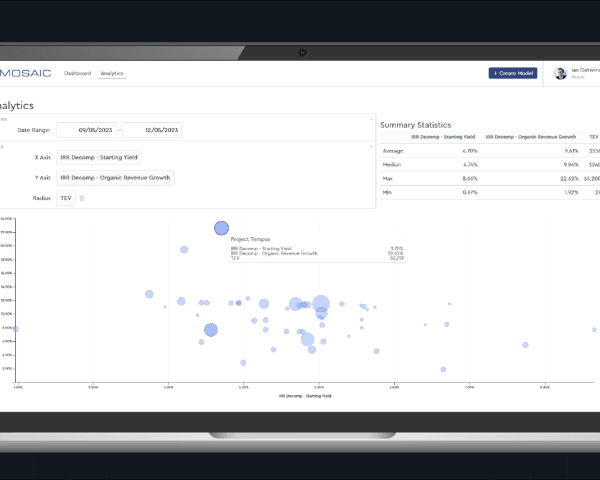

Mosaic Deals Analytics™: Unlocking Insights Trapped in Spreadsheets

Learn how private equity firms can gain unparalleled insight into their teams' new deal underwriting activity through Mosaic Deals Analytics™ - the industry's first analytics and reporting layer built on the world's #1 Digital Deal Modeling™ platform.

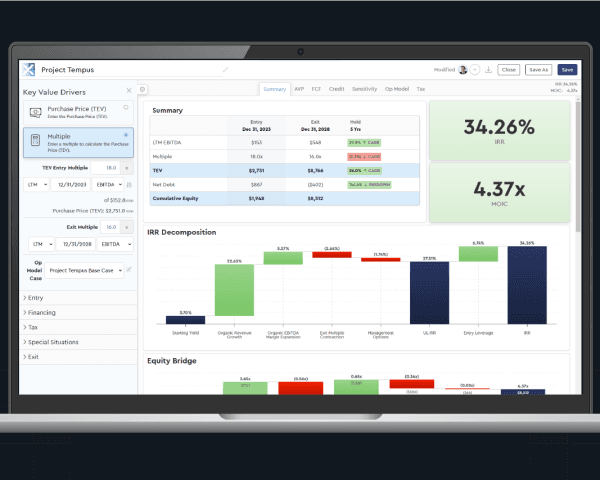

The Future of Digital Deal Modeling: Unveiling Mosaic's Game-Changing Platform Update

We're excited to announce the latest release of Mosaic – the world’s leading Digital Deal Modeling™ platform trusted by thousands of deal makers managing over half a trillion of assets. Dive into the future of private equity, today.