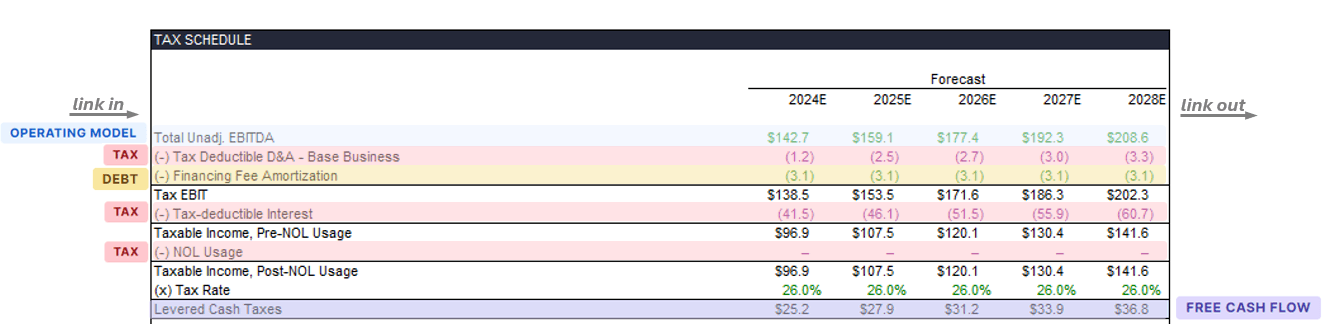

The purpose of the Tax Schedule is to calculate cash taxes on a levered basis for use in the free cash flows schedule. With increasing complexity of the tax code (particularly the Tax Cuts and Jobs Act of 2017 in the U.S.) – this is no longer as straightforward an exercise as it was in the early days of PE. We now need additional sub-schedules in our tax schedule to calculate:

Tax Deductible D&A, including any Bonus Depreciation available to us

Limitations on Tax Deductibility of Interest Expense incurred

Net Operating Losses – creation, usage, and limitation on their use

The table below presents the summary schedule for Levered Cash Taxes and the linkages in and out across the six core schedules: